The LGA has published a review of options for the future financing of local government.

The Budget and Spending Review in October 2021 provided an increase in grant funding for councils, and outlined some changes to local government revenue financing, including some to business rates.

The £4.8 billion in grant funding allocated for local government over the next three years will help to pay for some – but not all – of the increasing service demand pressures that councils face.

In addition, business rates reforms included measures designed to support high streets and incentivise net-zero investment, with the possibility of an online sales tax that could be used to fund further reductions in business rates.

Despite these announcements and reforms, significant issues remain over the future of local government revenue financing.

LGA analysis has suggested that, even after taking the increased grant funding into account, councils will face at least a £1 billion shortfall in their ability to keep services at 2019/20 levels, in terms of quality and access, by 2024/25.

This future funding gap is set against the background of council revenues that have been squeezed significantly in recent years, with £15 billion of cuts to central government funding for councils between 2010 and 2019.

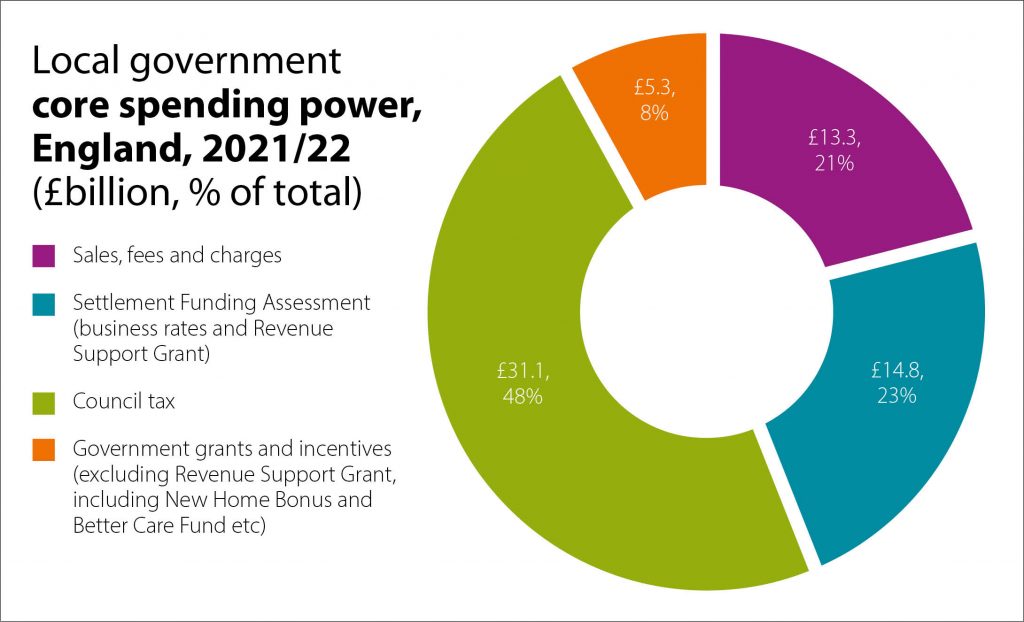

From 2016 to 2019, increases in ‘core spending power’ – the Government’s assessment of the revenue resources available to local government through the annual finance settlement – were down to increases in council tax rather than funding from central government.

The LGA has long argued that council tax is not the solution to paying for the growing costs of services, particularly social care, as it raises different amounts in different areas unrelated to need.

While local sources of income – including council tax, but also business rates, sales, fees and charges – have also become increasingly important to councils (see graphic), the COVID-19 pandemic has had a significant impact on these, with losses of around £9.7 billion, albeit central government provided some compensation for these losses in 2020/21.

Given this context, we think now is the time for a more fundamental look at how councils are funded, to ensure they are financially sustainable in the longer term.

Consequently, the LGA commissioned WPI Economics to carry out an objective review of current and alternative sources of revenue finance, and an assessment of their strengths and weaknesses.

Its report, ‘Reforming revenues’, identifies four significant issues with local government revenue financing that remain unresolved:

- adequately funding councils to deliver services of an acceptable standard

- making the UK taxation system fairer for those who pay taxes

- giving councils more tools to encourage local growth

- enabling councils to deliver policies that have a wider societal benefit (such as reaching net zero).

While all of these issues are interlinked to some degree, the first is arguably the most pressing. For example, councils are going to be on the frontline in delivering wide-ranging social care reforms, and credible analysis suggests that current funding plans may not allow the reforms to succeed.

“The LGA has long argued that council tax is not the solution to paying for the growing costs of services”

The report analyses the options for reforming local government revenue financing under three headings:

- the current system and reforming it – looking at council tax, business rates and smaller revenue sources (sales, fees and charges, road-user charges, and workplace parking levies)

- making national taxes local – looking at how some, or all, revenue from existing national taxes could be assigned or devolved to council areas

- introducing new local taxes – looking at how entirely new revenue sources could be implemented by councils, such as a tourist levy or a proportional property tax.

Options for reform under each of the above headings were assessed against a set of principles that the LGA argues should guide the design of local government revenue financing – sufficiency, buoyancy, fairness, efficiency of collection, predictability, transparency, and incentive.

‘Reforming revenues’ draws three main conclusions. First, reform of the current system would go some way to addressing the problems with local government revenues.

A reformed council tax and business rates system would help to address issues of sufficiency, unfairness, and supporting local economies. In respect of assigned and devolved national taxes, income tax is the revenue source that meets most of the LGA’s principles for reform.

Second, being clear on what local government is ‘for’ will guide which reforms are most necessary.

If councils are just to be delivery arms of central government, then issues around sufficiency and fairness are more important than incentivising local economic growth or enabling better societal outcomes.

If councils are to be free to have significant autonomy in local areas, then the incentivising principle becomes more important.

Finally, there are some options for local revenue reform that should be discarded, as they don’t meet enough of the principles for good revenue reform and do not address any of the problems with revenue financing. Localising inheritance tax and vehicle excise duty fit into this category.

There are other options that would only be pursued if an overhaul of the system were to be considered.

There are many merits, for instance, in replacing council tax with a proportional property tax or single property tax, but large transition costs to implementing them.

The LGA does not necessarily endorse any of the suggested finance reforms – the reason for assessing them in this way was to produce, as far as possible, an objective comparison of the options.

The overarching purpose of the report is to contribute to the debate on a sustainable local government finance system, particularly following the funding announcements and reforms announced in the 2021 Budget and Spending Review.

While the focus of the report is revenue funding, capital funding is also very important and there are clear links between the two.

It is also clear that sources of funding, individually or together, would have to provide income for authorities in all tiers of local government, regardless of their ability to generate this income, otherwise services that support residents would be under threat in many areas.

Therefore, with any new income sources, or combination of sources, there will need to be some redistribution between authorities.

Councils have ambitions for their communities – economically, socially and environmentally. Any sustainable finance system and sources of funding should work to support local government to achieve these aims.

Only with adequate long-term resources, certainty and freedoms, can councils deliver world-class local services for our communities, tackle the climate emergency, and level up all parts of the country.